It’s fair to say that the NH90 program has had a challenging couple of years, with Norway, Sweden and Australia all announcing the cancellation or early retirement of their fleets, so the NHIndustries partners will have been relieved to end 2023 with some good news. Nick Baird explores.

That came in the form of the maiden flight of the German Navy’s ‘Sea Tiger’ variant of the NH90 NATO Frigate Helicopter (NFH), following the awarding of a contract valued at €2.7bn in November 2020 for 31 aircraft.

A welcome leap forward in capability

The Sea Tiger will replace the ageing Lynx Mk88A helicopters in German Navy service. Originally delivered in Mk88 guise starting in

1981, the fleet was supplemented with additional airframes to the Mk88A standard in the late nineties with the original aircraft undergoing

an upgrade to the same standard. The Mk88A brought a sensor upgrade with the addition of a 360º chin radar and FLIR turret above the

nose.

In addition to being a more modern platform, the Sea Tiger is significantly larger and more capable than the Sea Lynx it replaces. The Sea Tiger is rated for a maximum takeoff weight of 10.6 tonnes vs 5.3 tonnes for the Lynx, with a maximum range on internal fuel of 982 km vs 528 km for the Lynx. However, this increase in size and weight will prevent the Sea Tiger being operated from the German Navy’s four current F123 ‘Brandenburg’ Class ASW frigates which will continue with the Lynx until they are replaced by the new F126 ‘Saarland’ Class vessels from 2028. Current F124 ‘Sachsen’ air-defence and F125 ‘Baden-Württemberg’ general purpose frigates are each able to carry two NH90s, as will the F126.

The German Navy’s primary tasks are defence of territorial waters and protecting NATO’s ‘Northern Flank’ of the North and Baltic seas. With Russia’s renewed aggression in Ukraine and the growing importance and vulnerability of sub-sea infrastructure, the Sea Tiger will provide much improved anti-submarine and anti-surface warfare capabilities based around a significantly enhanced sensor suite and mission systems when compared to the Sea Lynx it replaces. Sensors include:

Thales European Naval Radar (ENR) with 360º surveillance and targeting capability.

Leonardo’s LEOSS-T - a modular, turreted electro-optical system capable of incorporating a selection of up to 8 IR, TV and laser sensors.

Thales FLASH SONICS sonar system comprising low frequency wideband dipping sonar coupled with active and passive sonobuoy processing systems.

Next generation ESM Conf3 Electronic Support Measures.

The weapons fit also represents a substantial upgrade in capability over the Sea Lynx, comprising the latest MBDA Marte ER anti-ship missile – a ‘fire and forget’ active radar guided missile with a range in excess of 100 km, and the EuroTorp MU90 lightweight anti-submarine torpedo.

Sea Lion Synergies

With available options including the AW-159 ‘Wildcat’ successor to the Sea Lynx and the MH-60 Seahawk, the German Navy cited “a smooth transition and synergies in later operations” as the reason for selecting the Sea Tiger as its Lynx replacement. This selection follows the 2015 contract to replace Sea King helicopters in German Navy service with another variant of the NH90 – the ‘Sea Lion’. With deliveries completed in early 2023, the German Navy received 18 Sea Lions to provide Search & Rescue, maritime reconnaissance, transport and special forces support capability. The Sea Tiger shares a high degree of commonality with the Sea Lion, the main difference being the addition of the naval warfare mission systems.

That commonality is also shared with other operators of the naval NH90 NFH platform, including Belgium, France, Italy, Netherlands and

Qatar. Airbus report however that the Sea Tiger program took the opportunity to address obsolescence issues, including replacing

on-board computers with the latest generation systems alongside the installation of the sensor and mission systems described above.

Despite a multi-national user community and over 100 NFH variants in-service alongside over 300 Tactical Transport Helicopter (TTH)

variants, the NH90 program has suffered setbacks and controversy since entering service in 2007. A highly advanced design, the program

at the beginning was affected by various technical problems, long lead-times and late deliveries. Fifteen years on, significant

problems remain, the most significant of which are poor availability and the extremely high operating costs of the helicopter.

Operators have reported hourly operating costs in the order of 2½ to 3 times that of either the platforms they replaced, or alternatives

such as the Blackhawk/Seahawk. There have also been well-publicized problems with the supply and availability of spare parts, severely

impacting availability.

NHIndustries’ loss is Sikorsky’s gain

The operating cost and availability issues have led to some high-profile program cancellations and early retirement of aircraft. In 2022, Norway announced that it would terminate its contract with NHIndustries and return the 13 aircraft delivered out of a contracted 14. Moreover, it is demanding a refund of the nearly 5 billion Kroner it has paid so far. Unsurprisingly, NHIndustries is rejecting the request for a refund and has offered to repair the returned aircraft in an escalating dispute that may end up in court. What isn’t in dispute is that the Norwegian aircraft were significantly late in delivery and entry into service, with the Norwegian Ministry of Defence further claiming that the fleet on average achieved only 700 annual flying hours against a target of 3900.

Perhaps even more controversial was the 2021 decision by Australia to retire early its NH90s (designated MRH-90 ‘Taipan’ locally), a decision that was accelerated following a fatal crash in July 2023. The MRH-90 program was dogged by controversy from the start, with an Australian National Audit Office report revealing that the Department of Defence had recommended the procurement of the Blackhawk prior to the 2004 decision to buy the MRH-90, a political decision that was expected to benefit Australian industry. While the Australian aircraft suffered several groundings for technical issues alongside poor availability and problems with the provision of spares, there have been suggestions of poor management of the program including the implementation of Australia-specific modifications, failure to follow maintenance recommendations, and poor spares management systems. It is also important to note that at date of publication the inquiry into last September’s fatal crash is ongoing, and many in the NH90 community stand by the safety record of the aircraft and dispute that the cause of the accident is due to an intrinsic problem with the aircraft itself.

Further controversy followed the September 2023 decision to accelerate the retirement of the airframes, due to the speed and manner that the Department of Defence proceeded with the disposal. Following a hasty and fruitless exercise with Airbus to seek a buyer for the complete aircraft, the Department of Defence began stripping the airframes of usable parts and planned to bury the hulls. In December 2023 the Ukrainian Government lodged a request with Australia to acquire the aircraft to support their war with Russia, only to be told that it was too late, and the Department of Defence was committed to the disposal strategy that was already underway.

Nonetheless, it appears that stripped parts from both the Australian and Norwegian fleets will be used to provide a major boost to the pool of spares available to other users and will significantly ease NHIndustries support headaches.

The beneficiary in both cases has been Sikorsky, with Australia placing an order for 40 UH-60M Blackhawks in February 2023 to join the MH-60R Seahawks already in-service and on-order for the Royal Australian Navy, and Norway ordering 6 MH-60R Seahawks.

Upgrade or downgrade?

While the Blackhawk and Seahawk family are highly respected, combat-proven and benefit from the critical mass provided by the large numbers in service with the US armed forces, the NH90 is not without its benefits and supporters. The NH90 NFH has greater range and internal cabin capacity than the Seahawk, and it remains popular with pilots due to the flying qualities provided by the 4-axis fly-by-wire system. While those benefits are moot if you can’t achieve sufficient operational flying hours, other operators seem to have had a more positive experience with the platform. As might be expected, NHIndustries ‘home’ country operators – France, Germany, Italy, and the Netherlands remain committed to the platform and have various upgrade and modernisation plans in place. It is also interesting to compare the experience of the Royal New Zealand Air Force with that of the Australian Army. The RNZAF appears to satisfied with the flying hours they achieve with their small fleet of 8 NH90s, which they ascribe to a more proactive approach to maintenance, but commonality and the ability to cooperate on the implementation of modifications and upgrades with their nearest neighbour undoubtedly influenced New Zealand’s choice of the NH90 in the first place, so Australia’s decision will not be welcome across the Tasman Sea.

NHIndustries and its partners have acknowledged the availability problems that have plagued the NH90 program, and in 2020 launched a customer support transformation plan to address the problems with the high maintenance burden and poor availability of spare parts, and is studying a life extension program to extend the original 30 year life, potentially as far as 50 years.

Towards a Teaming future

Last year the German Navy published its “Objectives for 2035 and beyond”. This stated as one of its priorities the need for a “comprehensive maritime situational picture” delivered by “unmanned sensor systems”. The accompanying target fleet structure contained a plan for 10 shipboard unmanned aerial vehicles operating alongside the 31 Sea Tiger crewed helicopters by 2031, with a target of 22 from 2035. This plan is underway with a contract placed with ESG to supply 3 ‘Sea Falcon’ rotary UAVs for operation from K130 corvettes. The Sea Falcon is based on the Skeldar V-200 from Swedish Manufacturer UMS Skeldar. This offers a 235 kg maximum take-off weight, provides an electro-optical sensor suite and is controlled from a base station on board the ship.

Future requirements will be more ambitious, and with increasing emphasis on the deployment of uncrewed military assets, established crewed platforms such as the NH90 need to plan for a future where Manned-Unmanned Teaming (MUM-T) is at the core of operational doctrine. To that end, the European Union has funded a European Defence Industrial Development Program known as ‘MUSHER’, with the goal of developing of a generic European Manned Unmanned Teaming system and allowing manned rotorcraft platforms and unmanned platforms from European forces to interoperate.

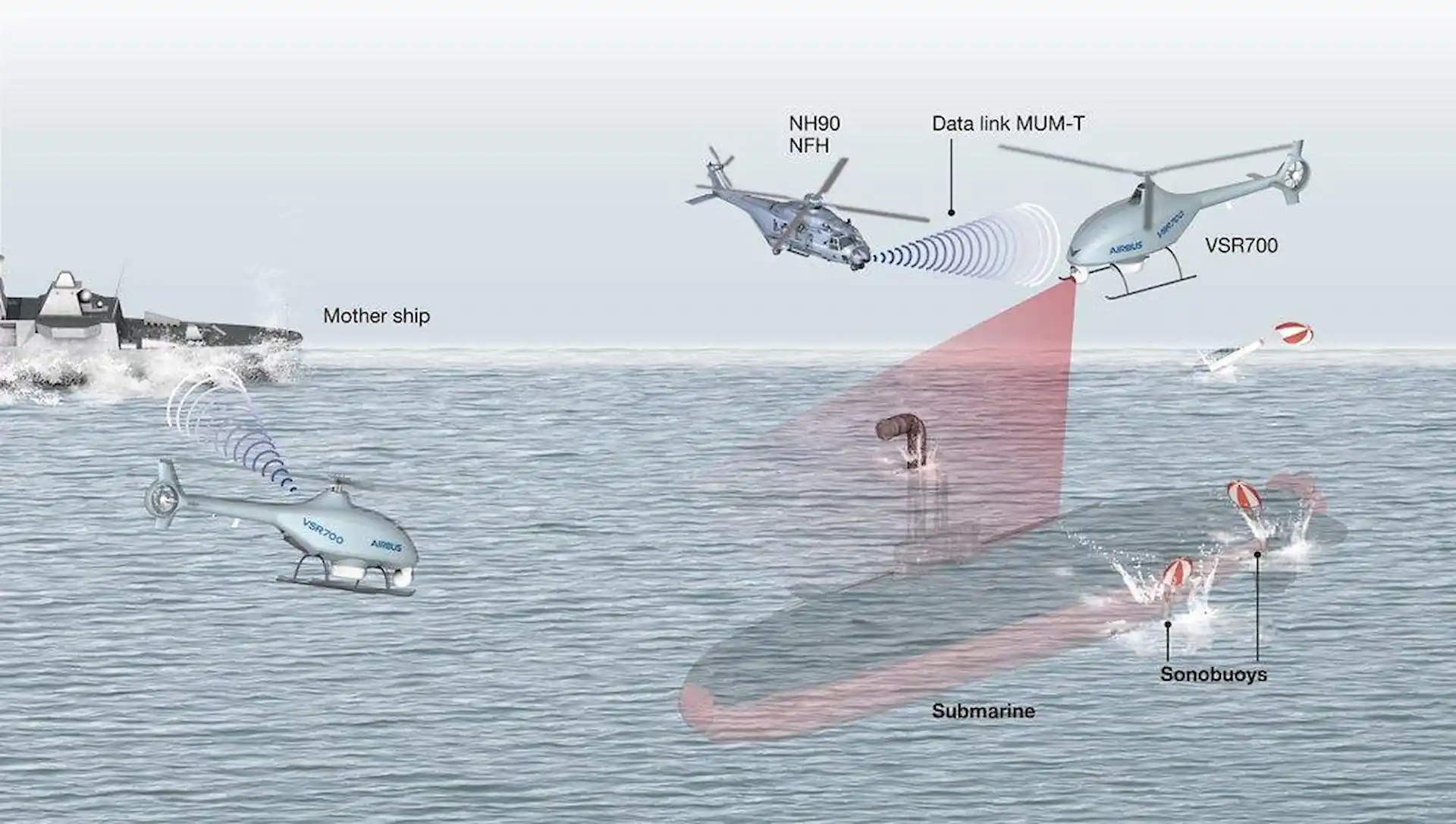

Since 2017, Airbus has been developing the ‘VSR700’ unmanned aerial system (UAS), supported by funding from the French Navy under the Système de Drone Aérien Marine (SDAM) project. Based on the Cabri G2 light helicopter, VSR700 is an uncrewed platform with a maximum take-off weight of 760 kg, and is sufficiently compact to fit into a ship’s aircraft hangar alongside a conventional helicopter. Designed for rapid role change with interchangeable payloads including radar, electro-optical and communications intelligence, or sonobuoy launchers and magnetic anomaly detectors in the anti-submarine role, VSR700 offers an impressive endurance on-station of 8 hours. It will also be capable of carrying a lightweight weapons fit, or carrying survival supplies to be dropped during search and rescue (SAR) missions. Initial shipboard trials took place in October 2023, operating from a French FREMM-class frigate.

Airbus anticipate VSR700 cooperating with crewed helicopters such as the NH90 NFH in a MUM-T arrangement, relaying sensor data and extending the ship’s sensor horizon. The greater endurance of the VSR700 when compared to conventional rotorcraft also allows for targets to be surveyed for extended periods of time, and is also a significant benefit for SAR operations. Flight demonstrations of manned-unmanned teaming will take place under the MUSHER program during 2024.

VSR700 is not the only platform that will be demonstrated under the MUSHER program. Leonardo will also demonstrate their ‘AWHero’, a purpose-designed rotary UAS for naval operations. AWHero is significantly smaller and lighter than VSR700, with a maximum take-off weight of 200 kg and a rotor diameter of only 4m compared to the 7.2m of the VSR700. This results in a smaller payload and lower endurance, although at 6 hours this still compares favourably to crewed rotorcraft. Like the VSR700, it can also carry a range of modular and interchangeable payloads including radar and electro-optical sensors, and sonobuoy data relays in its nose and underbelly payload bays.

The ball is in NHIndustries’ court

The NH90 program has suffered some major setbacks and the high-profile loss of several customers to the Blackhawk/Seahawk has been embarrassing, but NHIndustries and its partners at least acknowledge the problems their operators face. While the modernisation and improved support plans for the platform are reassuring, they will need to dramatically improve aircraft availability and lower the eye-watering operating costs before the German Navy’s decision can be judged to have been correct from an operational rather than political viewpoint.

HOME

HOME